IF YOU IMPORT, YOU NEED TO TAKE ACTION NOW!

The Customs Handling Import and Export Freight (CHIEF) is now receiving few new registrations ahead of closing for all import declarations on 30 September 2022.

The system will stop accepting new registration requests from importers from 10am on 5th July 2022. Instead, they will need to register with the Customs Declaration Service (CDS) to make their import declarations.

The Customs Declaration Service will replace CHIEF, representing a significant upgrade by providing businesses with a more user-friendly, streamlined system that offers greater functionality.

This marks the first step towards the government’s vision of a Single Trade Window, which will have considerable benefits for businesses through reduced form-filling, better data use across government and a smoother experience for users.

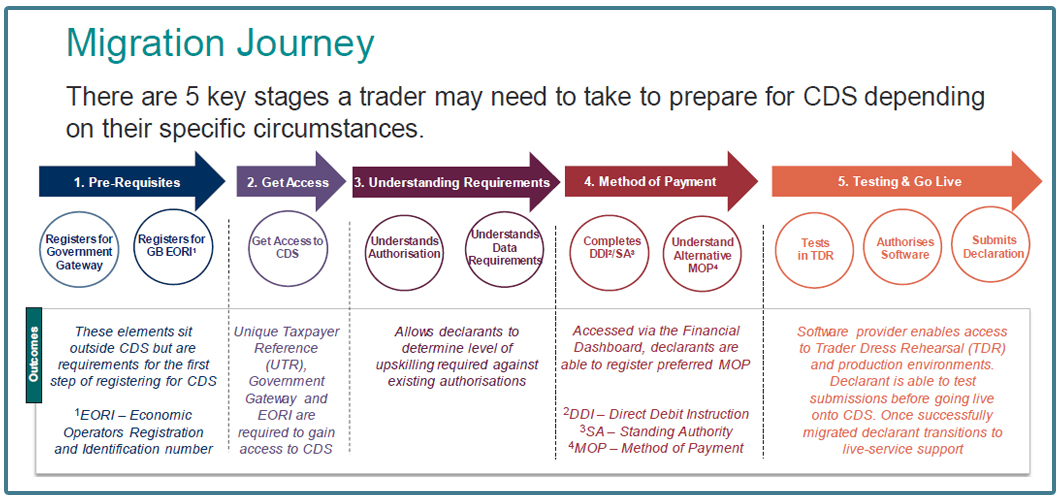

To use CDS there are a number of actions that you need to take now.

CDS operates differently to CHIEF, as your customs agent we can help you to understand the new data elements, the CDS tariff, how to operate your CDS deferment account and how the cash account system works.

To register to use CDS you will need to log into your Government Gateway account and provide:

* Your EORI number that starts with GB

* Unique Taxpayer Reference (UTR)

* The address for your business that we hold on our customs records

* National Insurance number (for individuals or sole traders only)

* The date you started your business

* Your email address

Once registered:

✓ You will be able to access your Financial Dashboard.

✓ You will be able to access the Secure File Upload Service if you need to send HMRC supporting documents, like licences or certificates of origin.

× Registering doesn’t provide access to submit a declaration.

We can help you to navigate the changes ahead.

ABOUT CHAMBERCUSTOMS

This service offers traders a high level of compliance with HMRC procedures and offers a direct link for customs clearance through all sea, air and road ports and terminals in the UK.

With our extensive knowledge, reputation and first-class service in facilitating international trade, we can take the hassle out of your hands when it comes to exporting and importing goods.

The service is offered direct to businesses and through freight forwarders, ensuring that customs clearance is accurate, timely and avoids additional costs through delays or errors.

With direct links to the HMRC Customs handling system and all inventory linked ports, we can ensure that your goods, no matter where they enter or leave the UK, will be cleared for onward transportation smoothly.

We can help you keep your time-sensitive supply chains, moving efficiently and economically.

“We’ve used Kent Invicta Chamber for our logistic needs for the last few years. The advice they have given me has proved invaluable on many occasions. Sofie recently assisted me on a particularly difficult import, saving us a lot in duty payments, and me, many headaches! Sofie and Ben are extremely helpful and are a font of knowledge on all things import and export. I cannot recommend them highly enough.”

Tracey Tillinghast, Logistics Manager, Balfour Winery

Importing and exporting after Brexit

From 1st January 2021, all goods moving between the UK, the EU and beyond require a customs declaration.

Understanding and implementing these changes post-Brexit as a busy, globally trading business – means extra paperwork, headaches, and hassle.

Customs Declaration Services from the experts

If you would like to save time and resources, outsourcing your customs declarations to a Customs Agent or Customs Broker like ChamberCustoms is easy.

We can simplify this process for you, filing your customs declaration forms and additional paperwork on behalf of your business, ensuring you are HMRC compliant.

Alternatively, if you’d like Customs Advisory Services or you are looking for Customs Training for your team, we can help here too.

All ChamberCustoms will need, to set you up for success while exporting and importing goods, is a few business details including your EORI number and business address and we will guide you through the process seamlessly from there.

Our customs clearance agents will:

✓ File customs declaration forms

✓ Hassle-free customs clearance for your imports and exports

✓ Speed up the whole customs clearance process

✓ Guide you through exporting goods out of the UK

✓ Guide you through importing goods into the UK

✓ Keep your business compliant with HMRC

✓ Keep you right with import duty and taxes

✓ Provide excellent customer services for your customs clearance solutions

✓ Supply expert advice and professional support

✓ Provide expert training in customs - import and export

✓ Provide bespoke advisory services for your trading business

A T1 is a transit document which allows for goods which originated outside the European Union to move freely within the European Union.

The main benefit is that no customs duties or taxes are payable as the shipment moves from one country to the next within the European Union. This is the case until the shipment arrives at its intended final destination.

Goods destined for a European Union destination (Sweden for example) arriving into a UK sea port from outside the European Union (India for example) do not have to be customs cleared and duty paid on arrival at the UK port if a T1 document is in place.

Instead the goods would be customs cleared in the country of destination (Sweden in this scenario) with any import duties and taxes being paid at the local rates applicable in Sweden rather than the UK.

Using our reliable and accurate transit documentation service, we can ensure the smooth and compliant transit of your goods across the EU.

Whether you need a T2 for community goods from the EU or bought in the EU or T1 for non- community goods, we can help.

Driver collection service available.

Why do I need UK Customs Declaration Training?

From 31 December 2020, when the UK completed its departure from the EU, the number of customs declarations made by traders is forecast to increase from 55 million to around 300 million each year.

Now that the UK has left the EU’s single market and Customs Union, ChamberCustoms is committed to improving the ease and efficiency of Customs Declarations for all traders importing and exporting in the UK. We support those businesses continuing to trade with the EU now that the transition period has finished.

Businesses that import or export goods will need to complete a greater amount of administration when clearing goods through UK ports in Great Britain and Northern Ireland; this is why we have created HMRC Customs Training, to support your business through these changes.

Why choose ChamberCustoms for Customs Declaration Training?

ChamberCustoms is a wholly-owned subsidiary of the British Chambers of Commerce, which has been helping traders to trade across the globe for almost 140 years.

We don’t just talk about trade. We helped traders export over £16bn of goods (in 2020 alone). We also provide customs brokerage services, training, and advisory support to businesses in the UK; we can help you control your imports and exports.

ChamberCustoms helps traders keep on trading now that the UK is no longer in the EU single market and customs union.

A potentially complicated process is made smooth, compliant and entirely transparent.

customs@kentinvictachamber.co.uk | 01233 503838 (Option 3) | www.kentinvictachamber.co.uk

BROUGHT TO YOU BY

SUPPLIED BY

BROUGHT TO YOU BY

Kent Invicta Chamber of Commerce

Ashford Business Point, Waterbrook Avenue, Sevington, Ashford, TN24 0LH

Copyright 2021